How Bidenomics failed

In trying to outrun fossil fuels, America is locked on a dangerous environmental and political course.

Whatever its early intentions may have been, and they certainly seemed well-intentioned when it came to shifting the US to clean energy, by the end the Biden administration appears to have simply capitulated to the oil economy. The prevailing narrative of the US economy is one of tech and clean energy driven growth. Yet, in this new data analysis, we find a shadow story of oil and gas driven growth. This is not at all what you hear when the US productivity and growth “miracle” is discussed. Yet, it is a stark reality as we will see.

If the 2010s were a decade of disillusion then the 2020s are a decade of delusion. If anything, the US will become even more intensively an oil and gas driven economy, especially with a second Trump administration on the way. Perhaps it was impossible for the Biden administration to shift decisively away from oil and gas in the face of legal challenges from big fossil producers to allow them to lease and drill federal lands. Putin’s invasion of Ukraine put a premium on domestic energy security. And congressional politics with power in the hands of fossil energy rich states like West Virginia may have tied the President’s hands. There’s always a reason to have one final beer before going home.

It might be that the US is simply incapable of getting to Net Zero - and what does that say about US democracy? The reality though is that the administration gave up without a real fight, preferring to tell a story of a productivity boom driven by clean energy and tech instead even if that story contains huge holes. Meanwhile, the US became a net petroleum exporter in the early 2020s and, if anything, production looks like it will accelerate. You can’t outrun fossil fuel, however. Countries who are large scale producers are also large scale consumers; US carbon emissions per capita are double the EU’s and total emissions are declining far more slowly from a much higher base. If you smoke and vape at the same time you are still at high risk of lung cancer. Eating salad on top of a high fat diet doesn’t make you healthy.

In a much reported speech, Jake Sullivan, Biden’s National Security Adviser, outlined the core principles Bidenomics:

“Too many people believed that we had to choose between economic growth and meeting our climate goals.

President Biden has seen things totally differently. As he’s often said, when he hears “climate,” he thinks “jobs.” He believes that building a twenty-first-century clean-energy economy is one of the most significant growth opportunities of the twenty-first century—but that to harness that opportunity, America needs a deliberate, hands-on investment strategy to pull forward innovation, drive down costs, and create good jobs."

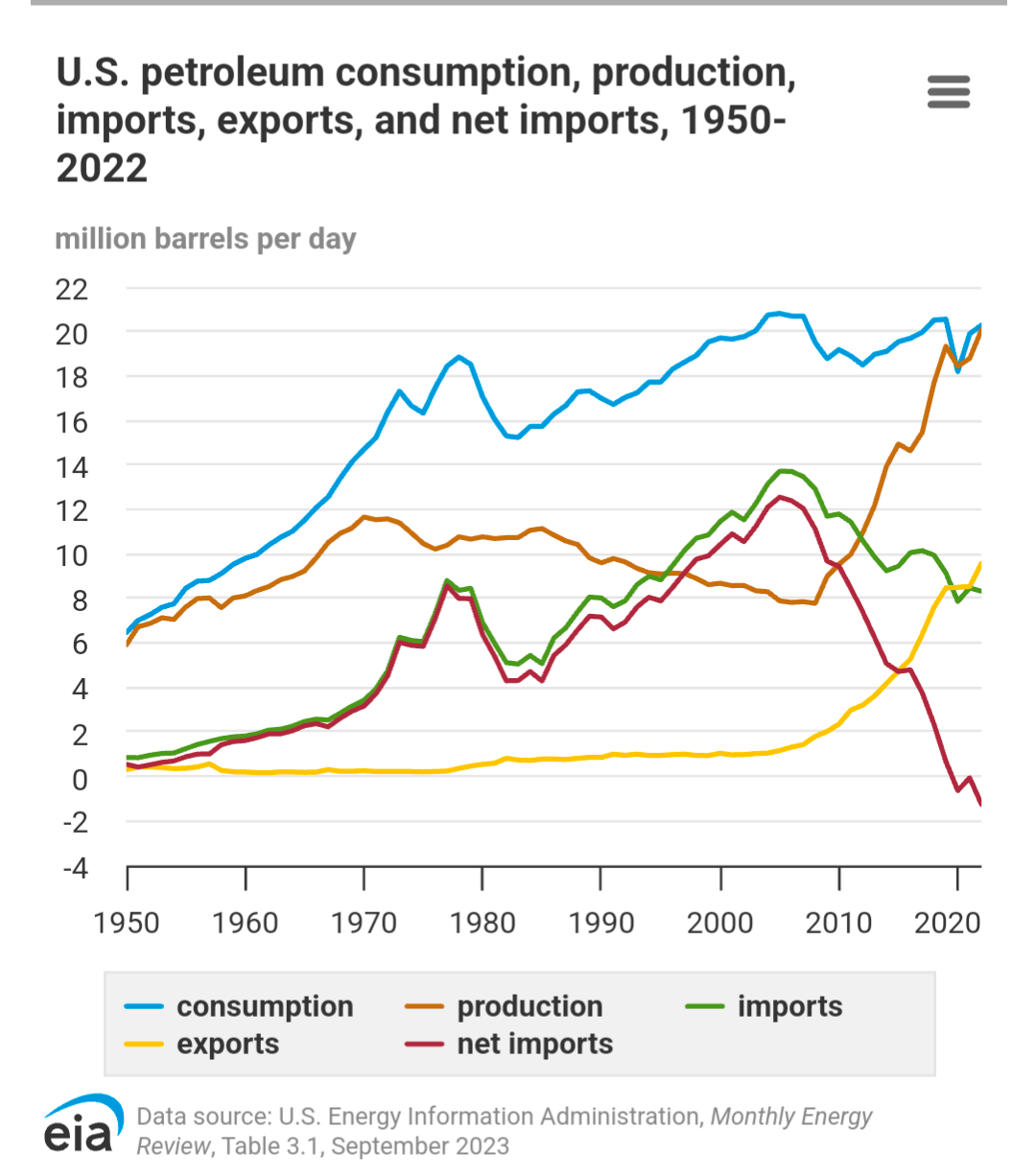

It’s an audacious set of claims. Oil is mentioned once in the speech in reference to security of supply in the 1970s. And yet, as we shall see, oil and gas are a very prominent factor in US productivity and growth. As you shift your economy towards fossil energy you increase its productivity significantly and, as productivity also improves with the sector, there is a further boost. And so you see economic growth, especially in a period of high energy prices. And here is what has happened to US petrol consumption, production and trade in recent times:

Basically, US petrol consumption hit a peak in the early 2000s and stayed there and levels of production have soared. Now, you could argue that other countries consuming US petrol products is their responsibility and not that of the US. And you’d be wrong. Carbon emissions are about both production and consumption. Responsibility rests on both sides of the equation. Supply and demand interplay, not least when it comes to lowering prices through increased production, they are different sides of the same nickel of environmental damage.

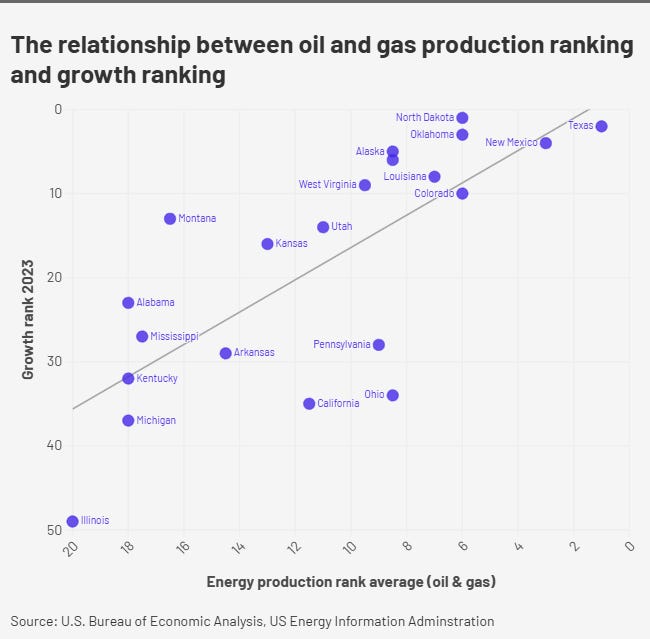

Robert J Shiller has explored the phenomenon of “narrative economics” and the narrative of a clean tech economy we can see in discussions about the Biden administration and, for example, the Inflation Reduction Act, may help drive investor behaviour. The Nasdaq is up by a third since Biden came into office. But the narratives have also obscured much of what is actually going on. So let’s look at three stories side by side in the full calendar year before the presidential election. I have taken data on growth ranks by US state for 2023 and compared them to oil production, green investment, and state tech output (the timeframes aren’t always identical but they broadly capture the state picture). Let’s start with the green investment boom story:

Now we see that a lot of swing states in the presidential election have done quite well out of green investment: the likes of Arizona, New Mexico, Georgia and Nevada. We also see that the relationship between green investment and growth is pretty weak. Now it might be that we can expect to see future growth as a result of this investment. But we are trying to tell a story of US economic performance now and this factor doesn’t appear, by itself, to be a significant driver. I’ve drawn a best-fit line for the hell of it but it’s hardly necessary. What about the technology story?

Again, we see a very weak relationship. Washington state has a big tech footprint and high growth. California has a high tech footprint and a lower growth ranking. North Dakota, which is very important in our overall growth story as we will see, has little tech but lots of growth. The tech story certainly does account for major shifts in the US economy, capital, and productivity over time but we just don’t see it particularly strongly in this snapshot (and it is a snapshot). Perhaps we should look at another sector like, maybe, oil and gas, and see what the relationship looks like here.

Look, there’s our friend North Dakota again but this time it’s high up the sectoral rankings- it turns out that the state is an oil and gas powerhouse. It also turns out that we have a much stronger fit here than with tech and clean investment. And we can see how well red, Republican stronghold states are doing out of the oil and gas economy.

Now, the year I have looked at here is 2023 and some might object that, as it was a year of high energy prices, that this could be an anomaly. But that’s exactly the point- you would expect the growth rankings of oil and gas producing states to swing around with changes in prices and production. And the Biden years have been an era of higher prices in the main. We can see this in the share prices of the major US oil producers such as Exxon, ConocoWilliams, and Chevron all of which have soared in the early 2020s.

A number of implications flow from these data. Firstly, the Biden administration has been telling a story of the US economy that is at best incomplete and at worst deliberately misleading. Secondly, early on in the administration they basically gave up taking on big oil and surrendered to it instead which, notwithstanding some emissions reduction and the growth of renewable electricity and electric vehicles, has left the US dangerously saddled to intensifying fossil energy production. The International Energy Forum has projected that US upstream capital investment in oil and gas will need to increase by $77bn a year by 2030. President Trump will be all too happy to oblige with extra icing on top of the cake. Federal land leases and permits to drill will fly around like confetti and how, given the Biden record, can the Democrats object?

Furthermore, these data do seem to indicate that the narrative of a US economic “miracle” is vastly overstated. Digging rotted organic matter out the ground and burning it really isn’t that miraculous at all. Maybe Europe is not such a basket case after all. In a counter-narrative, John Springford notes that France has kept pace with the US productivity-wise in the past decade and that is without environmental carnage. The average French person produces a little over a third of the carbon emissions of the average American.

And the biggest implication of all is that if your democracy is incapable of choosing non destructive forms of economic growth then you have a profound issue - especially if you are the world’s leading power. President Biden’s National Security Adviser argued that we didn’t have to choose between growth and Net Zero. Whatever the truth of that maybe, and it’s the subject of quite a debate, what is clear from the US case is that we most definitely do have to choose between growth based on polluting our environment and growth based on ingenuity, inclusivity and innovation. That was a choice that the Biden administration failed to make. And now, Trump II will let the destruction rip.